As the dust has somewhat settled on a chaotic and contentious election cycle, I wanted to share some observations on the

events of the past month as they relate to capital markets and your investments. At the time of this writing, the Dow Jones

Industrial Average just posted the highest monthly gain since 1987 (up 11.8%) and investors continue to be amazed at market

performance against the backdrop of an ongoing pandemic and related economic headwinds. Below are four observations that

have been apparent over the past month:

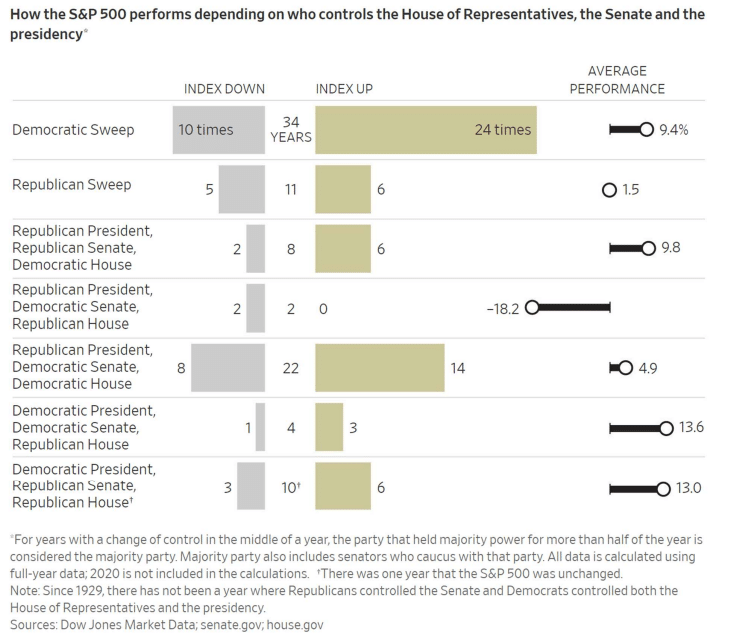

Observation #1: Markets Responded Positively to the Prospect of Gridlock

Markets do not do well with uncertainty, particularly uncertainty that is difficult to fully assess and quantify. Prior to the

election, fears existed about potential widespread civil unrest and the remote possibility of a constitutional crisis. These fears

were fortunately largely unrealized. Additionally, markets feared sweeping legislative changes which now seem unlikely as the

Presidency and House will be governed by Democrats while the Senate will likely remain Republican. When the President is a

Democrat, markets have historically performed best under divided governments. The logic here is somewhat intuitive-divided

governments need to either compromise (which reduces the likelihood of extreme outcomes) or they dig in further into deeply

held positions (which leads to little getting done and the status quo being maintained). Below is a comprehensive graphic of

how markets have fared under different governing combinations:

Source: Wall Street Journal

Observation #2: Vaccine Development is a Gamechanger

While society is currently in the throes of COVID cases spiking and weary of the pandemic, three viable vaccines have been

announced in the past month. Pfizer, Moderna, and AstraZeneca have all developed vaccines with high degrees of

effectiveness (AstraZeneca less so, but still 70% effective). This is a remarkable scientific achievement and portends an

eventual end to the pandemic. Significant production and distribution challenges remain, but capital markets have responded

extremely positively to this news. Additionally, Regeneron’s antibody cocktail has been approved as a viable therapeutic for

infected patients. The positive news on the COVID front has been key catalyst in November’s strong market performance

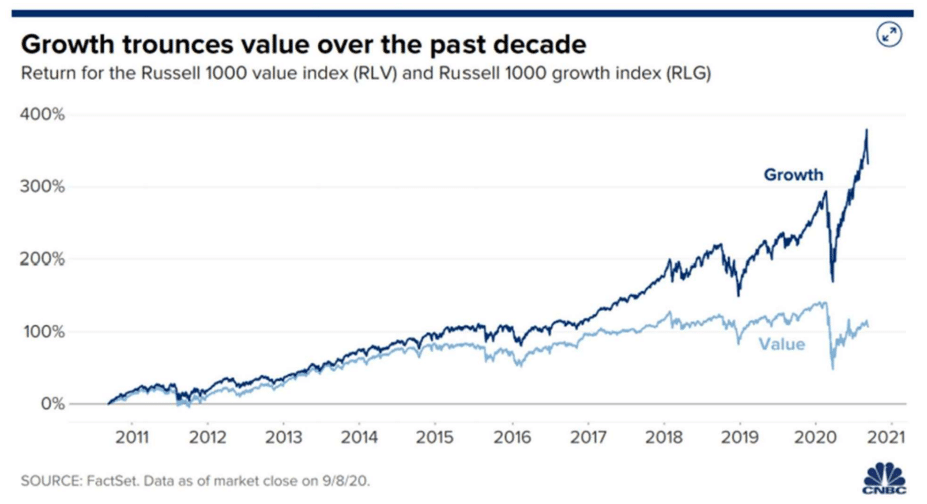

Observation #3: The November Rally Favored Value Stocks

There are innumerable ways to categorize stocks but there are two broad categories that capture most stocks: growth (think

Google, Microsoft, Nike) and value (think ExxonMobil, US Bancorp, Proctor and Gamble, etc.). Value has lagged growth for

many years and has been particularly hard-hit during the pandemic:

Source: CNBC

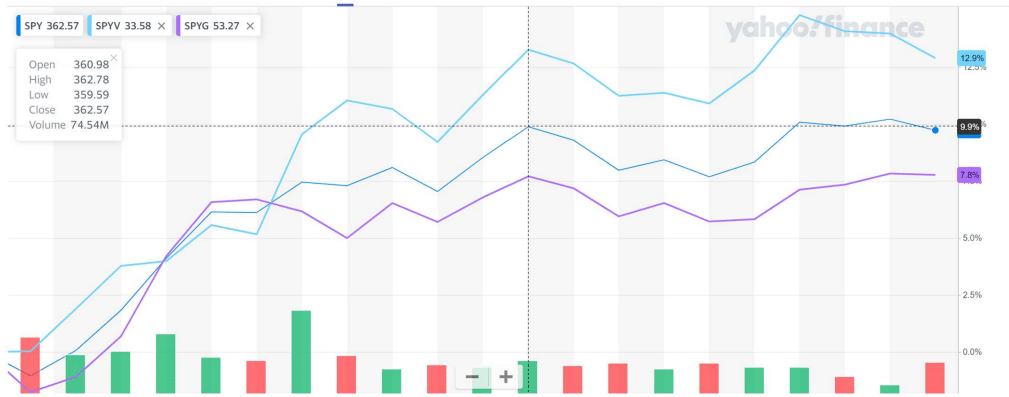

Since the election, however, value has outperformed growth by a pretty significant margin (over 5 percentage points):

Source: Yahoo Finance

There are significant tailwinds for value relative to growth. Price to earnings ratios are far more attractive (30X for growth vs.

18X for value) and beaten down value names stand to benefit from increased demand when we turn a corner with COVID. The

caveat here is that there is a dependency on the divided government thesis playing out. Should the Senate unexpectedly flip

Democratic in the Georgia runoff races, traditional value industries like energy and financial services could face significant

legislative and regulatory headwinds and value stocks could consequently struggle.

Observation #4: The More Different Things Get, The More They Stay the Same

While 2020 has been a unique year, the fundamentals of investing remain unchanged. 2020 has reinforced the following:

-Time IN the market remains far superior to TimING the market. Those who remained invested throughout the cycle

performed, far, far, better than those who did not

-Owning quality assets matters. Companies with strong balance sheets have fared far better than those that have not

-Stocks remain the best passive accumulator of wealth and inflation hedge

-Active share matters. Effective stock picking can and often does produce differentiated results

Whenever we hear the words “this time it is different” it gives us pause. Sticking to tried and true investing principles is the

best way to navigate troubled waters and 2020 has been no exception.

As we wrap up 2020, we wish you and your families a happy and safe holiday season. It has been a challenging year for many,

but our hope is that there have been silver linings, unique opportunities, and new perspectives gained. We are grateful for the

opportunity to work with such amazing clients and appreciate the trust that you have placed in us as your investment advisors.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Diversification, asset allocation and rebalancing strategies do not ensure a profit and do not protect against losses in declining markets. Rebalancing may cause investors to incur transaction costs and, when rebalancing a non-retirement account, taxable events may be created that may affect your tax liability.

Investing involves risk, including loss of principal. Supporting documentation for any claims or statistical information is available upon request.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance.

TownSquare Capital, LLC, is registered as an investment advisor with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the advisor has attained a particular level of skill or ability a SEC Registered Investment Advisor – 5314 River Run Drive Suite 210, Provo, UT 84604.