It has become cliché to talk about 2020 as a historic and wild year, but it truly has been just that. In financial markets, we have seen record volatility and huge price anomalies. Consider just a few:

-The S&P 500 index fell by over 30% from February 19 through March 23. This was the fastest decline to 30% in market history

-From March 23 to present the S&P rose nearly 51% and notched the fastest recovery in history

-As a result of economic stimulus and caution by investors and corporations, there is over $8 trillion dollars in cash on the sidelines. This is a record both in relative and absolute terms

-The spread between growth (think Microsoft, Google, Regeneron Pharmaceuticals, etc.), and value stocks (Chevron, US Bank, Proctor and Gamble, etc.) year to date is over 34 percentage points. Growth is up nearly 27% while value down nearly 8%. We’ve seen a tale of two markets.

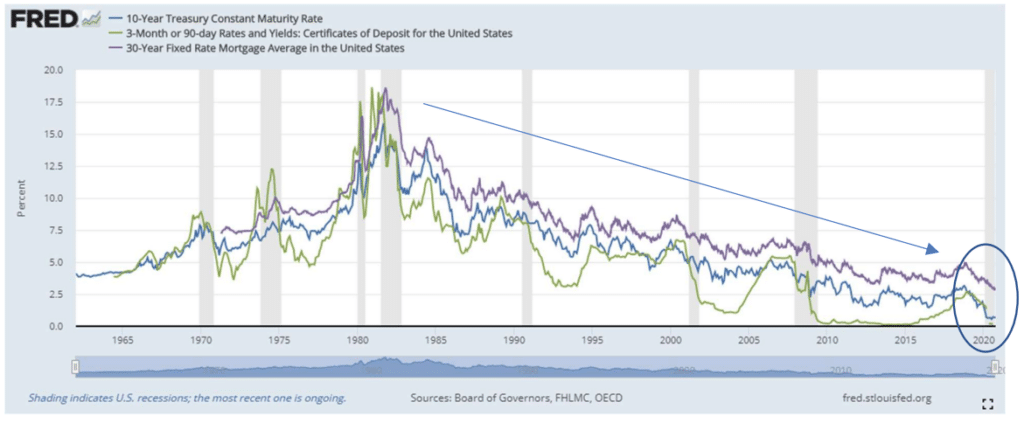

-Interest rates are near all-time lows and last spring, rates in the United States temporarily went negative. Rates are historically low by nearly any measure:

Source: Federal Reserve, markup added

It is this last point that I would like to spend some time on. Record low rates favor the expansion of credit and enable businesses and individuals to finance debt at a very low cost. Additionally, low rates tend to stimulate economic growth. Prolonged low interest rates, however, come with a significant cost. Prolonged low rates are often the companion of deflation and slow economic growth (Japan). Prolonged low rates also hurt savers and encourage excessive risk taking. Consider the current rates from the Wall Street Journal on each of the following:

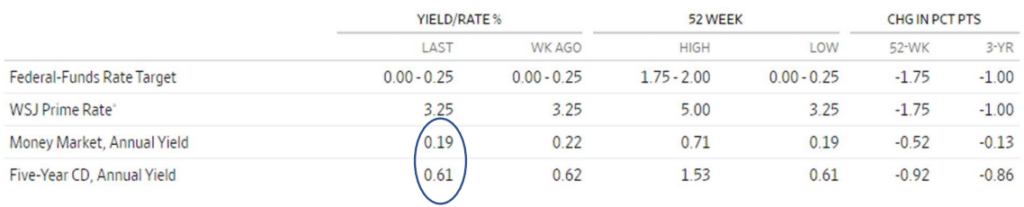

Corporate Bonds

CDs and Money Market

Look at these yields. .61% annual yield on a five-year CD! A yield of less than 1.5% on corporate bond. These low rates represent a drag on overall portfolio performance and one can reasonably question if the lack of liquidity (in the case of the CD) and credit/interest rate risk (in the case of the bond) is worth it. High yield bonds have better returns and have their place, but these face more credit risk (risk that the issuing company will default on its obligation) and fluctuate more in value than other fixed income options. The purpose of fixed income is to provide just that-a fixed level of reasonable recurring income and many traditional options are failing on this front.

What about the traditional role of bonds in a portfolio as a hedge when the stock market goes down? Historically the following dynamic often played out with bonds when stocks declined in value:

- Stocks declined due to economic slowdown

- Overall level of interest rates was reduced to spur economic activity

- As rates decline the value of bonds went up (bond prices move opposite of rates)

- The increase in bond values partially offset the losses in stocks

The challenge today is that rates are already low and there is not much room for downward movement. Rates cannot go much lower so the ability of bonds to appreciate in value is somewhat muted. Moreover, in a COVID world many companies are struggling and credit risks abound, so one’s principal may be more at risk than in prior economic cycles.

We live in a world where there is an embarrassment of riches in terms of good equity strategies and a comparative famine in the fixed income space. Are there better fixed income options out there? Below are a few ideas to consider:

Insurance Contracts. Insurance contracts like fixed index annuities can fill an important niche in portfolios. Unlike corporate bonds or bond mutual funds, these products usually have contract guarantees protecting principal and offer returns linked to market performance. In market declines, these do not fall in value. Good contracts can provide potential tax advantages, better downside protection than bonds, and some participation in market upside. Key considerations here are limited liquidity (typically a “free” withdrawal of 10% in a given year) and “cap rates” (level of market participation is capped or limited).

Dividend-paying stocks from companies with strong balance sheets. Given the market dislocations from COVID-19, Dividendpaying stocks represent an opportunity to collect a relatively high level of income and potential price appreciation on the

underlying stocks. COVID-19 has wreaked havoc on the stock prices of “value” stocks. As such, many of these names are a comparative bargain and dividend yields have climbed. The Russell 1000 Value Index, for example, has a dividend yield of 2.84% and a price to earnings (P/E) ratio of 15.96. For comparison, the S&P 500 has a P/E ratio of 38.21. Value is significantly cheaper than the overall market and the dividend yield is significantly higher than the current yields on bonds. One of our value strategies has a dividend yield of 4.9% and there are some great opportunities in this space. Success, however, is predicated on companies not cutting dividends and value companies turning a corner with performance and one must be comfortable with equity price fluctuations.

Bond Ladders. Bond ladders are means of buying individual bonds with staggered maturities. Bond ladders that we are currently using are typically comprised of bonds with maturities of 2-7 years. When one bond matures, the proceeds of that bond are then invested in a new bond at current market rates. Because the investment is continually “laddering” into new bonds and because the bonds have relatively short maturities, interest rate risk (the risk that rates rise and bonds fall significantly in value) is reduced. We’ve long advocated owning individual bonds in laddered strategies over owning bond mutual funds.

“Tactical” Asset Managers. Tactical strategies are those that attempt to correctly time entry and exit into the market. There are tactical bond and tactical equity strategies with varying levels of risk. Many of these try to avoid large market losses and go to large cash positions during periods of market downturns. While a conventional buy and hold strategy usually provides superior long-term returns, tactical strategies can potentially provide lower volatility and solid returns.

Prior to implementing any of these strategies, consult your investment professional.

There is an adage in investing that I heard may years ago which I heartily subscribe to. It is “don’t reach for yield”. The idea here is making sure one is being appropriately compensated for risk that one is taking. In this low interest rate environment, we all need to be careful not to take too much risk in the pursuit of yield and we also may need to expand our view beyond the traditional stock/bond portfolio.

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Diversification, asset allocation and rebalancing strategies do not ensure a profit and do not protect against losses in declining markets. Rebalancing may cause investors to incur transaction costs and, when rebalancing a non-retirement account, taxable events may be created that may affect your tax liability.

Investing involves risk, including loss of principal. Supporting documentation for any claims or statistical information is available upon request.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve. Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance.

TownSquare Capital, LLC, is registered as an investment advisor with the SEC and only transacts business in states where it is properly registered, or is excluded or exempted from registration requirements. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the advisor has attained a particular level of skill or ability a SEC Registered Investment Advisor – 5314 River Run Drive Suite 210, Provo, UT 84604.